Pent-up demand for apartments combined with continued job and population growth pushed North Texas leasing activity and average rents to all-time highs in Q3 while the vacancy rate hit a 26-year low. The Dallas-Fort Worth multifamily market is on fire fueled by strong market fundamentals that include:

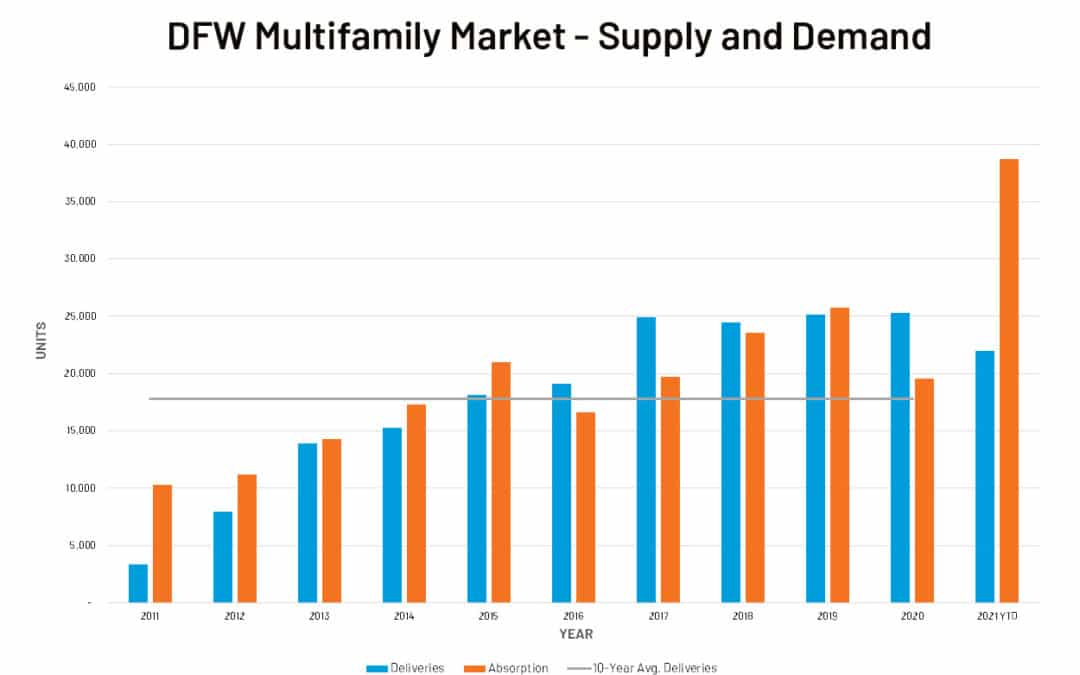

- Surging Demand – North Texas renters leased nearly 20,000 units in Q3, bringing annual absorption to more than 42,500 units — the highest recorded since RealPage began tracking the market in the early 1990s.

- Rising Occupancy – Overall occupancy increased 1.5 points for the quarter to 96.5%, resulting in the lowest vacancy rate since 1995.

- Unprecedented Rent Growth – The average effective rental rate among luxury Class-A properties increased 18.1% year-over-year in September to a record $1,652 as rent concessions offered to lure new residents all but disappeared.

- Increased Investment Activity – Strong investor interest in North Texas multifamily properties has helped push cap rates down to 3-to-4% for Class A properties, a drop of 50 basis points in the last six months.

- Increasing Population – The DFW area added more than 1.2 million residents from 2010 to 2020 and is projected to grow to 9.1 million residents by 2030.

Sources: Dallas Business Journal, Texas A&M REC, CBRE, JLL, RealPage, and the Hobby Center for the Study of Texas at Rice University. The chart was generated by OHT Partners.